———————————————————————————————————————————————————

———————————————————————————————————————————————————

[PAGE 1]

[PAGE 1]

R-53

Regulations on

Records to be Kept by Employers

Pursuant to Section 11 (c) of the Fair Labor

Standards Act of 1938 (52 Stat. 1060)

and Explanation

of the Records Regulations

NOVEMBER 1938

____________________________________________________

UNITED STATES DEPARTMENT OF LABOR

WAGE AND HOUR DIVISION

[PAGE 1]

======================================================================

[PAGE 2]

THIS PAGE WAS BLANK

[PAGE 2]

======================================================================

[PAGE 3]

[PAGE 3]

Regulations on Records To Be Kept by Employers Pursuant to Section 11 (c) of the Fair Labor Standards Act1

____________________________________________________

Section 516.1 – Records Required

Every employer subject to any provisions of the Fair Labor Standards Act or any order issued under this act shall make and preserve records containing the following information with respect to each person employed by him, with the exception of those specified in sections 13 (a) (3), 13 (a) (4), 13 (a) (5), 13 (a) (6), 13 (a) (8), 13 (a) (9), and 13 (a) (10) of the act:

(a) Name in full.

(b) Home address.

(c) Date of birth If under 19.

(d) Hours worked each workday and each workweek.

(e) Regular rate of pay and basis upon which wages are paid.2

(f) Wages at regular rate of pay for each workweek, excluding extra compensation attributable to the excess of the overtime rate over the regular rate.2

(g) Extra wages for each workweek attributable to the excess of the overtime rate over the regular rate.2

(h) Additions to cash wages at cost, or deductions from stipulated wages to the amount deducted or at the cost of the item for which deduction to made, whichever is less,3

(i) Total wages paid for each workweek.

(j) Date of payment.

Provided, however, That with respect to employees specified in section 13 (b) of the act, records referred to in paragraphs (f) and (g) of this section1 shall not be required; and

Provided further, That with respect to employees who are specified in section 13 (a) (2) of the act and employees who are defined in regulations of the Wage and Hour Division: Part 541— (Regulations defining and delimiting the terms “any employee employed in a bona

_______________

1 Issued under the authority contained tn section It (c), 52 Stat. 1060.

1 These three Items of Information are only required when overtime la worked by toe employee.

3 This Information is required only where the cash wage actually paid is less than the minimum wage required by the act. The reasonable cost of board, lodging, and other facilitiesas part of wages, is defined and delimited by regulations of the Wage and Hour Division : Part 531—(Regulations determining the reasonable cost of board, lodging, and other facilities pursuant to sec. 3 (m) of the Fair Labor Standards Act). This matter is dealt with further in Interpretative Bulletin No. 3 of the Wage and Hour Division.

107974* -38

[PAGE 3]

======================================================================

[PAGE 4]

[PAGE 4]

PART 516—REGULATIONS

fide executive, administrative, professional, or local retailing capacity, or in the capacity of outside salesman” pursuant to see. 13 (a) (1) of the Fair Labor Standards Act)—employers need make and preserve records containing the following information only:

(a) Name In fall.

(b) Home address.

(c) Occupations.

Section 516.2.—Form of records.

No particular order or form is prescribed for these records, provided that the information required in section 516.1 is easily obtainable for inspection purposes.

Section 516.3.—Place and period for keeping records.

Each employer shall keep the records required by these regulations for his employees within each State either at the place or places of employment or, where that is impracticable, in or about at least one of his places of business within such State, unless otherwise authorized by the Administrator. Such records shall be kept safe and readily accessible for a period of at least 4 years after the entry of the record, and such records shall be open to inspection and transcription by the Administrator or his duly authorized and designated representative at any time.

Section 516.4.—Definitions of terms used in these regulations.

(a) Act.—The “act” means the Fair Labor Standards Act of 1938.

(b) Hours worked.—For the purpose of these regulations the term “hours worked” shall include all time during which an employee is required by his employer to be on duty or to be on the employer’s premises or to be at a prescribed workplace.

(c) Workday and workweek.—For the purposes of these regulations, a “workday” with respect to any employee shall be any 24 consecutive hours, and a “workweek” with respect to any employee shall be 7 consecutive days, provided that the workday or workweek is not changed for the purpose of evasion of provisions of the act or any regulations prescribed pursuant thereto.

(d) Wage or wages.—For the purposes of these regulations, the term “wage” or “wages” means all remuneration for employment of whatsoever nature whether paid on time work, piece work, salary, commission, bonus, or other basis.

(e) Employee.—The term “employee” is defined by the act (sec. 3 (e)) to include “any individual employed by an employer,” and the term “ employ” is defined by the act (sec. 3 (g)) to include “to suffer or permit to work.” It shall be the duty of each employer to make and preserve all records required under these regulations with respect to each employee employed by him, whether or not such employees > perform their work in an establishment or plant operated by the employer or subject to his immediate supervision. Thus, the required

[PAGE 4]

======================================================================

[PAGE 5]

[PAGE 5]

PART 516—REGULATIONS

records shall be made and preserved by the employer for “industrial home workers” or other employees who produce goods for the employer from material furnished by him or who are compensated for such employment at piece rates, wherever such employees actually perform their work.

(f) Regular rate of pay.—For the purpose of these regulations, the term “regular rate of pay” means—

(i) With respect to an employee paid solely on an hourly basis (i. e., receiving no additional wage whatever): the hourly wage rate at which he is employed.

(ii) With respect to an employee employed on a daily, weekly, semimonthly,4 or monthly 4 basis for a regular number of hours per week determined by agreement or custom: the average hourly rate 5 obtained by dividing the wages 6 earned for that regular number of hours in the workweek by that regular number of hours; and

(iii) With respect to an employee paid on any other basis than those specified in (i) and (ii) of this Paragraph (f): the average hourly rate 5 obtained by dividing the wages 6 earned for the particular workweek by the total number of hours worked during that workweek.

Section 516.5—Petition on for amendment of regulations

Any person wishing a revision of any of the terms of the foregoing regulations on records to be kept by employers (sees. 516.1 through 516.4) may submit in writing to the Administrator a petition setting forth the changes desired and the reasons for proposing them. If, upon inspection of the petition the Administrator believes that reasonable cause for amendment of the regulations is set forth, the Administrator will either schedule a hearing with due notice to interested parties, or will make other provisions for affording interested parties an opportunity to present their views, both in support and in opposition to the proposed changes.

____________________

Approved by the Administrator October 21, 1938.

Published in the Federal Register, October 22, 1938.

____________________

4 With respect to an employee paid on a monthly basis, the wages earned during a work-week are computed by multiplying the monthly wage by 12 and dividing the remit by 52. With respect to an employee paid on a semimonthly basis, the wages earned during a work-week are computed by multiplying the semimonthly wage by 24 and dividing the result by 52.

5 In computing the average hourly rate fractions of less than one-half cent may be disregarded, and fractions over one-half cent should be raised to the next full cent.

6 In computing the average hourly rate all wages earned or paid during a particular workweek must be included except

a) Bonuses not computed on the basis of measured work performed (e. g . bonuses for punctuality, simple Christmas bonuses, etc.).

(b) Extra compensation attributable to the excess of the overtime rate over fite regular rate, and

(c) Additions to the cash wage for board, lodging or other facilities furnished by the employer.

[PAGE 5]

======================================================================

[PAGE 6]

[PAGE 6]

__________________________________________________

PURPOSE OF THE REGULATIONS

It is the purpose of the Regulations—Part 516—to assist employers in complying with the act and to assist the Administrator and his designated representatives in securing uniform enforcement of the act. Every effort has been made to coordinate the record-keeping requirements under this law with those under the Federal Social Security Act, the State unemployment compensation laws, and other statutes and thus reduce to a minimum the information required.

Paragraphs (e), (f), and (g) are explanations of information required in section 516.1 of the Regulations when overtime is worked (over 44 hours per workweek in the year ending October 23, 1939, over 42 hours in the year ending October 23,1940, and over 40 hours thereafter). When no overtime is worked, this information is not needed.

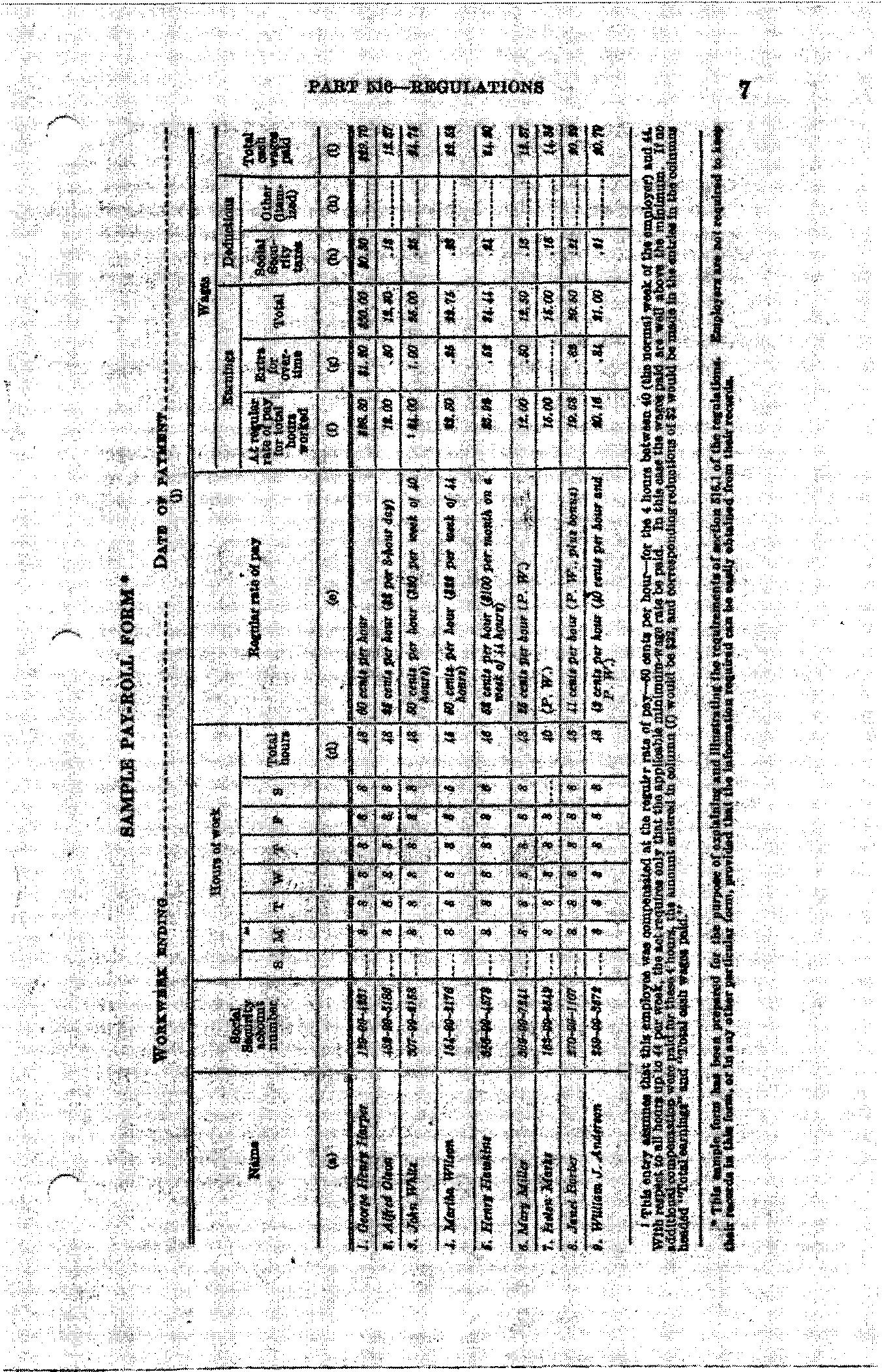

FORM OF RECORDS

The sample pay-roll form on page 7 is submitted merely for explanatory purposes. Required records need not be made or preserved in any particular form so long us they are readily available and contain information from which the information required by section 516.1 of the Regulations can be easily obtained. The sample form does not provide for recording such information as the worker’s home address or date of birth of those under 19. This information will probably be recorded on a separate and permanent record form.

It would be advisable for the employer, as a means of protection, to maintain, in addition to the pay-roll record, such basic records as those which are recorded by time clocks or time cards, or sheets which include the exact time of starting and stopping the workday and of the time of starting and stopping the meal period

[PAGE 6]

======================================================================

[PAGE 7]

[PAGE 7]

======================================================================

[PAGE 8]

PART 516 – REGULAT1ONS

EXPLANATION OF THE ITEMS OF INFORMATION REQUIRED IN SECTION 516.1 OF THE REGULATIONS

Paragraph (a)-Name in full.

It is important to have the full name of the worker as a means of personal identification. The name of a worker therefore should be entered as Ruth Ware, not R. Ware; Henry George Rogers, not H. Rogers. Middle names should be recorded. Nicknames should not be used.

Paragraph (b)—Home address.

Home addresses should be secured from employees and recorded, and a reasonable effort should be made to keep them up to date.

Paragraph (c)—Date of birth if under 19.

The date of birth should be recorded if it appears that the employee is under 19 years of age. Where persons under 19 are employed, an employer should write “minor” or its abbreviation on the pay roll before the name of each such person employed.

The Fair Labor Standards Act contains certain prohibitions on child labor, and employers are referred to sections 3 (e), 12, and 13 (c) of the act and to the regulations of the Children’s Bureau of the United States Department of Labor for further information — on this matter. Protection against violation of the act by employing a person under 18 can be secured by holding a certificate issued under regulations of the Chief of the Children’s Bureau of the United States Department of Labor.

Paragraph (d)—Hours worked each workday and each workweek.

A record of time worked each week must be kept for each employee subject to the act whether such employee is paid on a time work, piece work, commission, salary, or other basis.

While it is not required that the pay roll form show the hours worked each day, such a record would have great value in expediting inspection. Where not carried on the pay roll, the record of hours worked each day must be kept in such form as would permit of immediate use by the inspector should question be raised as to the accuracy of the pay-roll record on total hours during any one week.

A record must be kept of all time during which employees are required to be on duty or to remain on the premises, or to be at a prescribed workplace with the exception of regular meal periods.

The proper method of computing overtime is described in this explanation under paragraph (g) below.

Paragraph (e)—Regular rate of pay and basis upon which wages are paid.

Where no overtime is worked, no entry need be made for this item. Where overtime is worked (i. e., where the figure entered in column

[PAGE 8]

======================================================================

[PAGE 9]

[PAGE 9]

PART 516—REGULATIONS

(d) prior to October 24, 1939, is more than 44),7 there should be entered in column (e) sufficient information to determine the regular rate of pay by which overtime is calculated. The proper entry in this column depends on the basis on which an employee’s wage is paid:

For an employee paid solely on an hourly basis the proper entry is the hourly rate. Example (see line (1) of sample form) : “60¢ per hour.”

[PAGE 9]

PART 516—REGULATIONS

(d) prior to October 24, 1939, is more than 44),7 there should be entered in column (e) sufficient information to determine the regular rate of pay by which overtime is calculated. The proper entry in this column depends on the basis on which an employee’s wage is paid:

For an employee paid solely on an hourly basis the proper entry is the hourly rate. Example (see line (1) of sample form) : “60¢ per hour.”

For an employee paid on a daily, weekly, or monthly basis, who is employed for a regular number of hours per week determined by agreement or by the custom maintained in the establishment, the proper entry is the wage rate for the day, week, or month, reduced, as shown in the following three examples, to the proper average hourly rate:

EXAMPLES

Worker (2) on the sample form Is employed at $2 per day for an 8-hour day and works 6 full days in the workweek. His total weekly wage is $12 and his customary hours are 48. His average hourly rate is therefore 25 cents per hour ($12 divided by 48 equals 25 cents). The proper entry in column (e) is therefore “25 cents per hour ($2 per 8-hour day)."

Worker (3) on the sample form is employed for $20 per week of 40 hours, determined by custom in the establishment in which he is employed. His average hourly rate is therefore 50 cents per hour ($20 divided by 40 equals 50 cents). The proper entry in column (e) is therefore “50 cents per hour ($20 per week of 40 hours).”

Worker (5) on the sample form is employed for $100 per month, and by union agreement his regular hours per week are 44 hours. His weekly wage is calculated as $23.08 (12 multiplied by $100 divided by 52 equals $23.08). The proper entry in column (e), is therefore "52 cents per hour ($100 per month on a 44-hour week).”

For an employee paid on any basis other than those mentioned above in this explanation of paragraph (e), the proper entry is the wage rate for the daily, weekly, or monthly employee or the indication that the worker is a piece worker or is paid on some other basis, and in addition, the average hourly rate,.

EXAMPLES

Piece worker (8) on the sample form works 48 hours during the workweek and earns at piece rates, including a production bonus, a total of $19.68. Her average hourly rate is therefore 41 cents per hour ($19.68 divided by 48 equals 41 cents). The proper entry here is therefore “41 cents per hour (P. W. plus bonus).”

____________________

7 Except for 14 weeks in any calendar year in “seasonal industries” as determined in Regulations—Part 533—of the Wage and Hour Division, and where a collective-bargaining agreement made by representatives of employees certified as bona fide by the National Labor Relations Board provides that no employee shall be employed more than 1,000 hours during any 26 consecutive weeks or 2,000 hours within a year, in which cases overtime is more than 12 hours per workday and over 56 hours per workweek (section 7 (b) of the act.

[PAGE 9]

===================================

[PAGE 10]

[PAGE 10]

PART 516—REGULATIONS

Paragraph (f).—Wages at regular rate of pay for each workweek excluding extra compensation attributable to the excess of the overtime rate over the regular rate.

Where no overtime is worked, no entry need be made for this item.

This column (f) includes all wages 8 earned during a workweek for all hours worked but does not include extra earnings attributable to the excess of the overtime rate over the regular rate. For example (see line (1) on sample form), the proper entry in column (f) for an employee paid 60 cents per hour for 48 hours’ work is $28.80 (60 cents times 48 equals $28.80). This entry includes wages for the 4 hours overtime at the regular rate of pay. Additional overtime compensation for these 4 hours of overtime is calculated separately and entered in column (g).

The proper entry in column (f) is computed differently, depending upon the basis on which the employee is paid:

For a time worker paid at an hourly wage rate only, this item is the regular rate of pay multiplied by the number of hours worked in the workweek.

For a time worker paid at a weekly wage rate, this item is the weekly rate of pay plus a sum for all hours over 44 (computed by multiplying the number of hours worked la excess of 44 by the average hourly rate). (See line (4) on sample form.)

For a time worker paid at a monthly wage rate, this item is computed as follows: The monthly wage is reduced to a weekly wage by multiplying 12 times the monthly rate and dividing the result by 52. This weekly wage plus a sum for overtime computed as in the preceding paragraph, constitutes this item (f). (See line (5) on sample form.)

For a piece worker, this item is the amount earned at regular piece rates, including any production bonus. (See line (8) on sample form.)

EXAMPLES

Time worker (1) on the sample form is entered In column (f) for “$28.80” (60 cents per hour times 48, the number of hours worked in the workweek).

Time worker (4) on sample form paid at the regular rate of $22 per week is customarily employed 44 hours per week. Her average hourly earnings are therefore 50 cents per hour ($22 divided by 44 equals 50 cents). Since she has worked 1 hour overtime, her wages at her regular rate of pay for 45 hours are entered in column (f) as “$22.50” ($22 pins 50 cents equals $22.50).

Piece worker (8) on the sample form is entered in column (f) for “$19.68” (the amount paid for the number of pieces completed in the 48 hours of the workweek at the regular piece rates; plus a production bonus).

____________________

8 Except those wages specified in footnote 8 of section 516.4 (f) of the records recitations:

(a) Bonuses not computed on the basis of measured work performed (e. g. bonuses for punctuality, simple Christmas bonuses, etc.). * * *

(c) Additions to the cash wage for board, lodging, or other facilities furnished by the employer.

[PAGE 10]

===================================

[PAGE 11]

[PAGE 11]

PAGE 11PART 516— REGULATIONS

Paragraph (g)—Extra wages for each workweek attributable to the excess of the overtime over the regular rate. 9

Where no overtime is worked, no entry will appear for this item.

This item is the additional amount of earnings resulting from the extra rate of pay for overtime. This amount should equal at least one-half of the regular hourly rate of pay (or the average hourly rate) multiplied by the number of overtime hours.

EXAMPLES

Time worker (1) on the sample form is entered for "$1.20” in column (g) for this item (one-half of the regular rate of pay multiplied by the overtime hours; one-half of 60 cents multiplied by 4 equals $1.20).

Piece worker (8) on the sample form is entered for “$0.82" In column (g) for this item (one-half of the average hourly rate multiplied by the overtime hours; one-half of 41 cents multiplied by 4 equals $0.82).

Paragraph (h)—Additions to cash wages at cost, or deductions from stipulated wages in the amount deducted or at the cost of the item for which deduction is made, whichever is less.

This information is not needed if the cash wage is above the minimum required by the act. If the cash wage is less than the minimum required by the act, this entry should show the amount for each - item, or the actual cost of each item, whichever is less; and in the case of additions, this entry should show the actual cost of the additions claimed.

Regulations—Part 531—of the Wage and Hour Division define and delimit the reasonable cost of board, lodging, and other facilities as part of wages, as required by section 3 (m) of the Fair Labor Standards Act. Section 3 (m) of the Act is further explained in Interpretative Bulletin No. 3 of the Wage and Hour Division.

____________________

Interpretative Bulletin No. 4 of the Wage and Hour Division treats In further detail with the provisions for overtime compensation In section 7 of the Fair Labor Standards Act.

U. S. Government Printing Office

____________________________________________________________

For sale hy the Superintendent of Documents, Washington, D. C. * * * * Price 5 cents